People have so many questions about “the market” this year. It is always good cocktail conversation to chat about what the real estate market is doing. Gasp over the crazy offers that people make. Wonder what things will look like in 5 years. Remember what it was like 20 years ago. Or 50 years ago.

This is often the talk of the cocktail party or the dog walk.

But at home, sometimes the questions about the market are different.

What is my next move? Will I be able to afford to move to a larger house when I hoped to? Will I be able to retire and sell this house and then go do the next thing that I hope to do? Can I finally buy a home and stop renting?

We find that this is the market that people care about most. How does the current, and future, real estate market impact the goals that I have for my housing, my family, my retirement?

What are the most popular questions of 2020? Is this a great opportunity to buy at a steep discount? Has my home lost a ton of value? Should I be making a real estate move when so many bad things are happening to people? Should I be making a real estate move because there is a special opportunity right now that I shouldn’t ignore?

I have found myself talking with clients in recent weeks about how economic events have played out in the real estate market in Boston from the Panic of 1893, the Crash of 1929, Mid Twentieth Century housing policies and the urban exodus, the creation of condominiums in Massachusetts in 1970s, interest rates approaching 20%, the Savings and Loan Crisis of the 1980s (and some substantial tax law changes) the end of rent control in 1995, interest rates plummeting below 6%, 9/11, the Great Recession of 2008, interest rates dropping to 4%.

And now….Covid-19 has changed a lot of things for a lot of people. We are watching closely everyday to advise our clients and try to understand the choices that people are making and what is driving those choices and the values of the properties. I certainly hope that Covid-19 will be a singular event in my lifetime. So far, in the real estate market, it is taking its place in a long line of disruptive events that changed the landscape of the real estate market. But…the market has not “crashed”. Values are not plummeting.

There is a lot of trepidation in the real estate market and people have lots of questions. They worry about for sale signs in every yard and a glut of boarded up houses. But what we actually see are fewer houses for sale and prices are up, substantially in some places. Interest rates have dropped into the 2s. While the pace of properties coming to market came almost to a stop in April 2020, starting in mid-May there are record numbers of properties coming to market and going under agreement. The number of sales in 2020 looks at this point to stack right up against previous years by year end.

The single biggest change, I think, is the end of the commute as we know it. People are exploring completely different housing options. Different locations and larger homes to accommodate working from home.

What does the market look like in Milton right now?

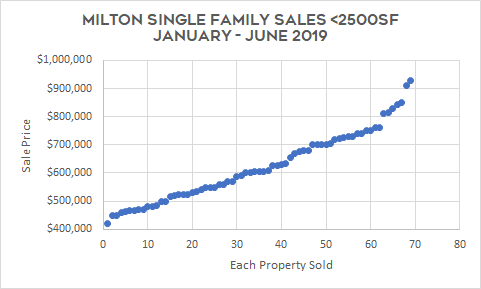

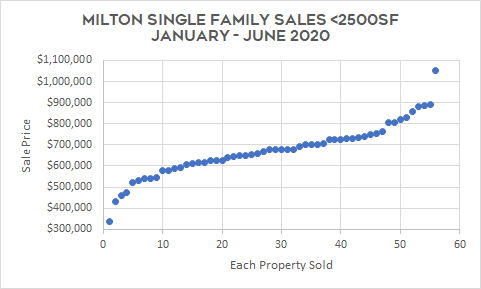

The only market that matters is the one for the type of property that you want to buy or sell. But as an example, single family homes smaller than 2500sf represent about half of the homes sold in Milton in many years.

Let’s compare 2019 to 2020.

In 2020, the number of units sold has lagged due to a reduction in listings and the ability to show property. As we move into July, we see every sign that the year will erase that deficit.

How do we use these numbers to advise clients? Applying an increase in the median sale to the value of a particular home does not reflect market conditions for that home. A move in median price is much more an economic indicator than either a determinant of value or a reflection of value.

Are you looking to buy or sell in Milton this year? Or not sure what your next should be now?

Give us a call and let’s talk about your home and your goals, inside Milton or throughout Greater Boston. The new commute for some people is the Cape, a farm, or the Berkshires. What’s your next step?

Stephanie Ford | David Gordon

617.480.5480